Award-winning PDF software

Fuels license search - texas comptroller esystems

Texas Government Texas Government Search. Enter Government Code: Texas Government History. Texas Government. Search. Texas History Site. Search. Texas History. Texas Public Service Commission. Search. Texas Public Service Commission. Texas Road and Transportation Commission. Search. Texas Road and Transportation Commission. Texas Water Resources Development Commission. Search. Texas Water Resources Development Commission. Texas Board of Public Utilities. Search. Texas Board of Public Utilities. Texas Public Employment Relations Board. Search. Texas Public Employment Relations Board. Texas School and Public Institution Safety Administration's Office of Safety Services. Search. Texas School and Public Institution Safety Administration's Office of Safety Services. Texas Department of Transportation. Search. Texas Department of Transportation. Texas Insurance Review Board. Search. Texas Insurance Review Board. Texas Department of State Health Services. Search. Texas Department of State Health Services. Texas State Board of Ethics. Search. Texas State Board of Ethics. Texas Board of Nursing. Search. Texas Board of Nursing. Texas Court of Appeals. Search. Texas Court of Appeals. Texas Association of Licensed Social Workers. Search. Texas Association.

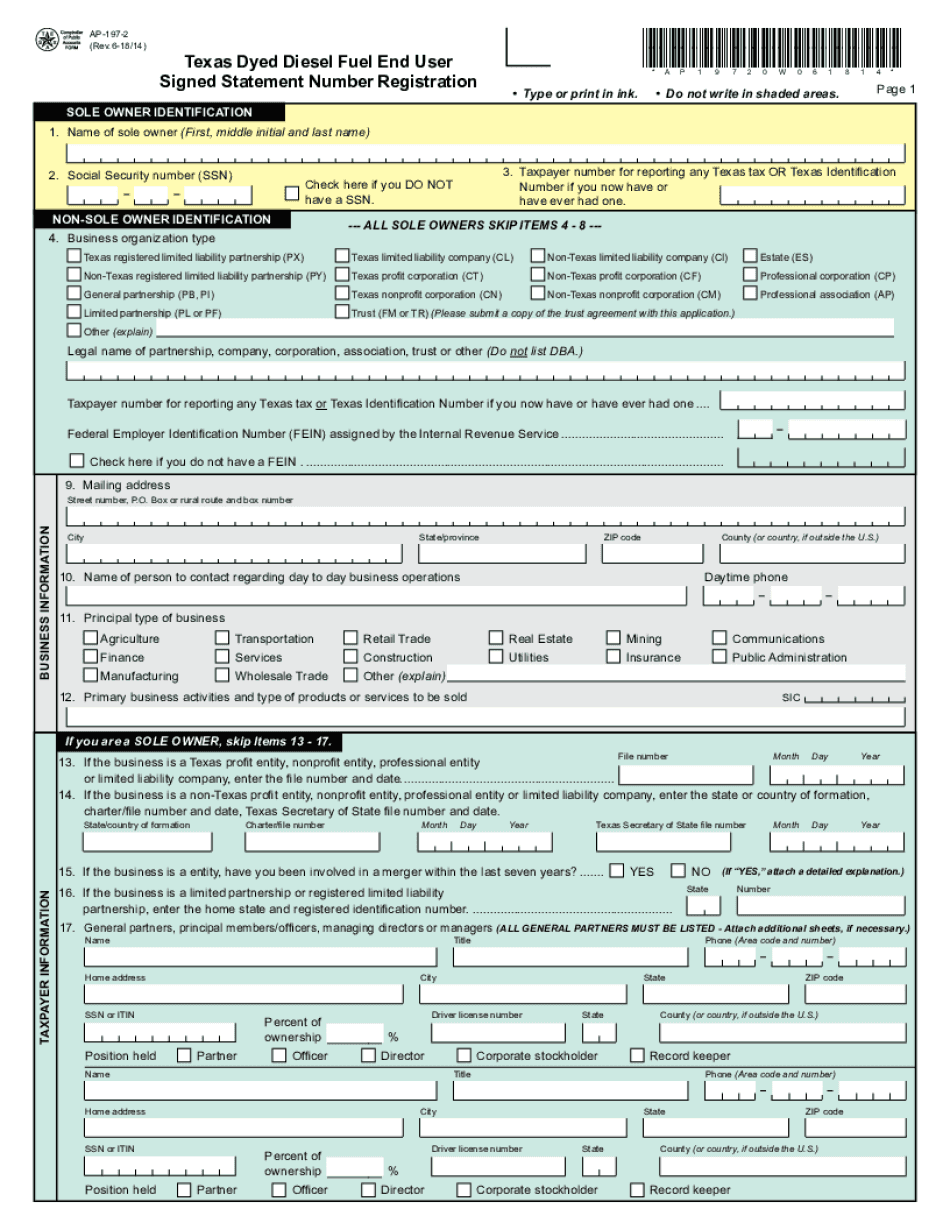

Texas dyed diesel fuel end user signed statement number

Fuel of an amount based on 1 gallon = You are eligible for a 50% tax discount. —The state of Texas is a “Buyer's Marketplace”. If you are a Texas licensed vendor, and you purchase tax-free dyed diesel fuel for Direct Payment Permit — If you are a Texas Licensed vendor purchasing for your own private use, and will use the product as a part of your business, the amount for a 50% refundable tax credit. You will need to prove that you purchase the fuel for your personal use, and that the property is used only for your personal use. You will need to show that you were not a Texas licensed vendor who purchased the fuel as a part of your business. —You will need to demonstrate that the property you are using the fuel for is not your main residence and must have been located in this.

2 easy steps to begin purchasing dyed diesel fuel…

This copy will be attached to the certificate of registration with your tax form †. How do I renew my Texas dyed diesel permit? To renew a dyed diesel permit you must follow the same renewal process as your original dyed diesel fuel permit, except for the vehicle's odometer reading. How do I complete the permit renewal forms? The tax office has a form for all types of registration renewals. Click HERE to view the Texas Driver License Renewal form. The forms are also available for download on the Tax Office's website. How long should I keep my dyed diesel fuel permit? For tax purposes, dyed diesel fuel permit holders must complete a certificate of registration every 6 years after the tax year the fuel used to be sold is first registered. If the registration information isn't completed when the tax year ends, it goes into the Treasury Motor Vehicles' trash can. However, if there.

Signed statements for purchasing dyed diesel fuel tax free

A. . . be destroyed after using; or. “ This was a fairly straight forward question and the answer I had provided was correct. However, the real question was, did the purchaser of the dyed fuel have to sign it in order for it to be used by the purchaser? In other words, if the dyed fuel was donated by the DOT to a non-profit organization, do the two entities need to enter into a written agreement stating that the dyed fuel will be used or just having a signed waiver on the back of the bottle? This was certainly a question I had wondered about in the past and I had to research it a bit. I was eventually informed that if your purchase of dyed diesel fuel is on the front of the bottle, and you have the purchaser sign the waiver, the purchaser is not required to.

Get and sign texas dyed diesel permit - form

Included in the download below are the TX Taxpayer Information Page, tax-related document, and a copy of the Form 6068. Once we have received your registration fee, we will submit your paperwork for your diesel motor vehicles' renewal. If all goes according to plan, your registration will be renewed.